Quietly gaining the odd small headline in early 2023 is a gamechanger for anyone interested in an electric bicycle for getting to work. Deloitte has written an excellent summary on the technical accounting considerations. Electric bicycles (and scooters and public transport) are no longer considered a fringe benefit in NZ law and as such, are not subject to Fringe Benefits Tax, rising ranks to the holiest of Auckland’s untaxed fringe benefits – the employee car parking spot.

So what does this actually mean and how does it result in half price e-bikes? Read on! The below of course is not legal or accounting advice as we are not qualified to provide either. Please refer to your accountant for advice on your company’s particular situation.

Whenever you buy something for yourself, you’re generally spending from your after tax income – ie your ‘take home pay’, after the tax has already been taken from your pay cheque. That’s certainly the case for most of our sales. Tired of being part of an insane traffic system, a customer/consumer/taxpayer (I’m sure we used to have a word for this – a human?) walks into the world’s best e-bike shop to look for a better way to get to work. After some expert advice and rides on the world’s best test-ride track, the taxed citizen, let’s call them ‘Mike’, selects Consumer Magazine’s most recommended ride – the Moustache xroad 3. Mike rolls away with the bike for $7,495 paid from his actual (after tax) money. EBT renders unto the crown $977 of Goods and Services Tax and the e-bike revolution turns another cog.

But what would it look like if their employer were to make the purchase instead? A discerning Auckland employer, let’s call them Newstalk, sees an opportunity to have more of their staff ride bikes, proven to reduce absenteeism and sick leave, not to mention enabling them to show up on time more reliably. Their sharp research cuts through the crowd and brings them to Auckland’s foremost expert on e-bikes for commercial use, who duly recommends that they offer (amongst many other ebike options), the Moustache xroad 3 to their staff to commute to work. The same $7,495 changes hands and the crown still gets its $977 GST from us. Then begins the most curious shrinking act.

Newstalk takes the invoice of $7,495 and claims back the $977 of GST, leaving them $6517 out of pocket. They’re 15% ahead of the mere mortal’s experience and we’re just getting started. To ‘pay the employer back’ (salary sacrifice), Mike needs to forego $6517 of gross pay. Mike is on a fair pay packet by anyone’s standards, contributing 39% marginal tax on his income, so a $6517 deduction sees him lose out on only $3779 of take home pay, assuming a 3% kiwisaver contribution rate. Are you feeling sorry for the Mike who paid twice that figure for the same bike just last paragraph? Don’t worry, he hasn’t bought one yet but perhaps this will be the year.

What’s this got to do with FBT? In yesteryear such a payroll manoeuvre would see Mike liable for fringe benefits tax (FBT) on that $3,779, at a rate of 64%. But now FBT is no longer applicable to e-bikes purchased by the employer for the purpose of staff travel to and from work.

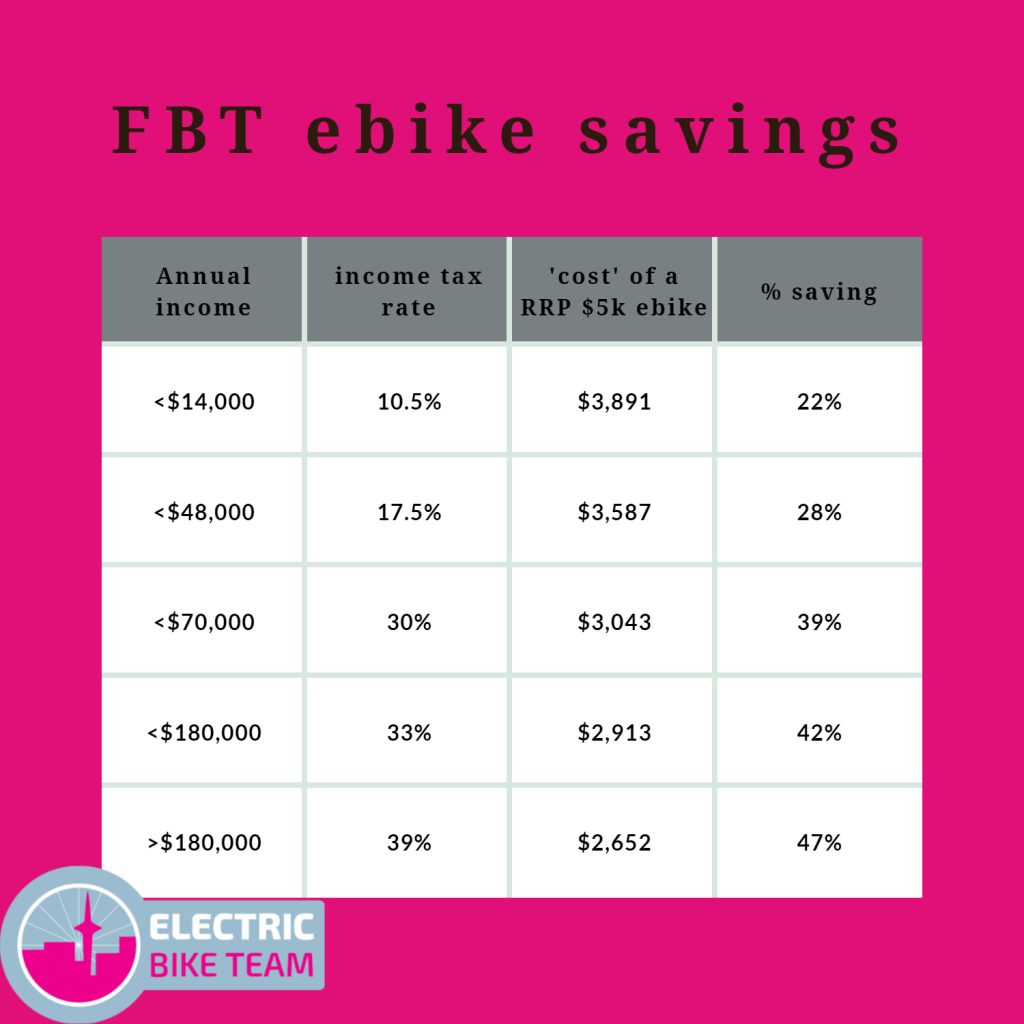

Most of us are on a lower tax bracket of course – we can’t all be like Mike – so here’s what the figures look like for each income situation. In these calculations, it is your ‘marginal’ tax rate that matters (the highest rate that any of your income is subject to), rather than the average. And because contributing less to your kiwisaver or student loan is hardly a ‘saving’, I’ve removed those from the calculations in the table below.

Would you like to get your staff onto e-bikes? There are some technicalities covered by the Deloitte piece. It is the employer that must make the purchase, not the employee. We can help you through all of that. Please contact us if you’d like to know which e-bikes we can offer your staff.

If you’re not the employer, by all means contact us to talk about your options and to see what ideas we might have to get your workplace engaged.